Nearly 8 months left: How feasible is US$12bn mining industry by 2023

Creator: Philimon Bulawayo | Credit: REUTERS

By Almot Maqolo

HARARE – Zimbabwe’s President Emmerson Mnangagwa remains confident that the US$12 billion mining sector by 2023 vision is achievable in his keynote address at the 42nd Independence Day commemorations in Bulawayo.

The southern African nation is envisioning a US$12 billion mining industry by 2023.

Of the US$12 billion, gold, platinum diamonds will contribute US$4 billion, US$3 billion and US$1 billion respectively. Chrome, iron ore and carbon steel will contribute US$$1 billion while coal and hydrocarbons will contribute the same. Lithium at US$500 000 while other minerals will constitute US$1.5 billion.

In his Independence Day speech, Mnangagwa highlighted that the mining sector has immense potential to spur socio-economic development and growth of our economy.

“Due to the responsive strategies, we are on course to achieve the target of a US$12 billion mining industry by 2023,” he said.

“It is also pleasing to note that Artisanal and Small to Medium Scale Gold Miners contributed 62% of the total gold deliveries to Fidelity Printers in 2021.

” The US$12 billion mining sector by 2023 vision is a quite ambitious goal considering the challenges currently being faced by the sector and the country at large. Since the mining sector does not exist in a vacuum other problems the economy is facing will cumulatively hinder the growth of the sector in question.

Despite having huge mineral deposits all over the country be it gold, lithium, platinum and cobalt which are always in high demand due to their increased usage in recent years, the country is yet to have a viable environment which makes it viable for investors to mine and get rewarded accordingly.

High cost of capital, unavailability of capital, infrastructure gaps, lack of respect for property rights and lack of adequate foreign currency for capitalization and retooling are all the hindrances the mining sector players should face. As of 2021 the mining sector was worth 4.4 billion the jump to 12 billion will need more problem solving to the above stated challenges.

However, Chinese mining companies with deep pockets seem to be on a buying spree buying mining assets all over Zimbabwe ignoring all the red flags due to their need for control in the supply chain of critical minerals like cobalt and lithium. Sinomine a Chinese mining giant recently acquired Bikita Minerals a lithium producer for USD 180 million while Huayou International just concluded the acquisition of Arcadia Lithium Mine which was majority owned by Australian Prospect Resources in a deal worth USD 422 million.

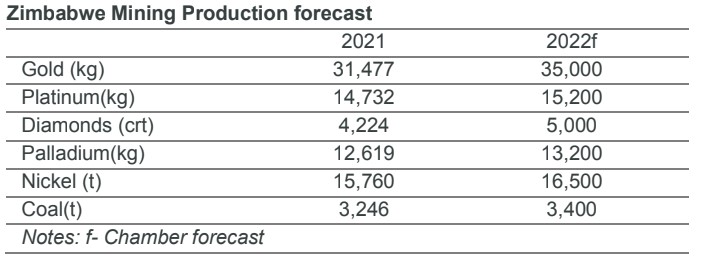

With the current underinvestment the huge mineral reserves Zimbabwe boasts with should ideally propel the mining sector. These minerals are already in high demand as the world shifts to using clean energy and the growing demand from the electric vehicles producers. Below is a table showing forecasts by the Ministry of Mines and Mining Development on different output projections for various minerals.

The 2022 budget shows the ambitiousness of the goal, in that the Ministry of Mines and Mining Development was allocated only $3 billion out of a total national budget of $927.3 billion. This is just a mere 0.3% of the budget for 2022. Considering the importance of the mining sector in Zimbabwe, from employment creation as well as supporting other ancillary sectors of the economy a 0.3% of a national budget cannot guarantee an 8% jump in the mining sector output.

The mining sector in Zimbabwe contributes immensely to the economy, it being the main source of forex for the country’s coffers. The current foreign currency retention thresholds for exports are very disappointing for the miners. The Victoria Falls Exchange (VFEX) which was launched in 2021 for exporting and mining companies to list there and have to retain 100% proceeds of the export revenues as well as raise capital in US dollars. No real benefit will flow to the mining sector considering that many miners in Zimbabwe are small-scale and many of these do not have the listing capabilities.

The resource prospects of a 12 billion mining industry by 2023 are abundant, what is left now is the action. There needs to be a drive for value addition in all minerals so that the country creates jobs locally and increases the value of exports. There should be a fair rewarding system especially at Fidelity which is the sole legal buyer and exporter of gold in the country. Opening up to more private players to the gold buying and processing can lead to reduced smuggling as well as reduce black market trades Above all the government must consider an upward review of the foreign currency retention threshold in the gold sector to motivate gold producers to sell their gold through the formal gold market.