Padenga’s results hinge on recovery in crocodile business, expansion of mining subsidiary

By Almot Maqolo

HARARE – Padenga Holdings diversified its product portfolio in FY 2020 from just being a crocodile concern company by making the strategic acquisition of Dallaglio, a gold mining company with big interests in the gold mining industry.

However, the general expectation in the market was for Padenga to diversify into export linked horticulture operations, which they did say they are still pursuing.

That decision to consolidate Dallaglio into Padenga proved critical to the operations of the company in the advent if Covid-19 which hampered the crocodile skins operations despite the increase in revenues.

The company’s margins were strained in fiscal year 2021 as client tastes shifted and the mining business expanded.

Due to a defensive Asian market, the group has previously noticed a shift in consumer dynamics in favor of smaller purses and thus smaller skins. Skins larger than 40cm/+ were rejected regardless of quality and were/will be sold at a discount, putting a strain on Padenga.

Crocodile skin sales volumes for the period under review remained firm at 39,936 skins. However, due to Covid-19-related prohibitions on unusual meat sales around the world, no export meat sales were made.

Revenue for the crocodile business was down 9% from US$27.28 million to US$24.70 million. It contributed 31% to Padenga’s total revenue. As a result, the crocodile business lost US$3.41 million during the quarter, compared to a profit of US$1.38 million in FY20.

The volume of skins sold in the alligator segment was down 47%, with the majority being lesser grade skins marketed to best advantage. The Texas operation remained hamstrung by oversupply and reduced demand in the market for watch band size skins, according to the researchers at Inter-Horizon Securities (IH) in an analysis of the firm’s financial results for the year ended December 31, 2021.

“The operation had been moving towards medium and large skin production because of improved margins in those size ranges but the shift to smaller skins that was also experienced by the crocodile business resulted in Tallow Creek having skins that could not be sold at viable prices,” IH said. Revenue for the alligator business declined 40% from US$3.96 million to US$2.36 million.

Also the business contributed 3% to Padenga’s total revenue. The segment made a profit of US$0.82 million during the period, compared to a loss of US$4.56 million in FY20.

Production from the newly commissioned Eureka mine and a revised open pit mine plan at Pickstone boosted mining volumes by 35% over the previous period.

Dallaglio’s income was US$51.38 million, accounting for 65 percent of Padenga’s total. Due to pre-operating expenses spent at the Eureka mine, the mining segment lost US$4.41 million from a profit of US$5.15 million.

Padenga’s total sales fell 10% year over year, from US$71.60 million to US$78.46 million. EBITDA for the combined operation fell by 36%, from US$23.76 million to US$15.10 million. Interest-bearing borrowings increased by 103% year over year, from US$16.91 million in FY20 to US$34.40 million in FY21. Borrowings have risen substantially to support the mining industry, according to the research firm.

It did not declare a dividend.

Looking ahead, IH noted that the crocodile skins company has limited upside because the group appears to be maturing around current levels of roughly 40k skins per year; in the short run, some effort may be required to adapt skin sizes to existing customer desire.

After years of underperformance despite management’s efforts and a variety of initiatives, the company plans to shut down operations at Tallow Creek.

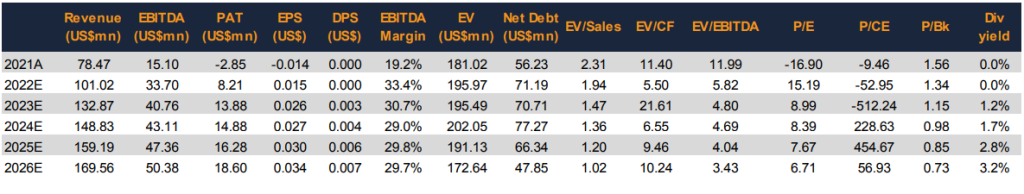

Padenga’s revenue for FY22 is poised to be at around US$101.02 million.

“Overall revenues for Padenga are expected to remain on an upward trend carried by extension of the gold mining operations, as well as higher forex retention given the VFEX listing.”

Eureka Gold Mine is resuming operations. Its plant is expected to boost gold production with a monthly average production of 115 kg per month.

“The mining operations are forecasted to produce 1,296kg (41,679oz) gold for FY22. Of concern is the narrowing profit margin as finance costs have increased to fund expansion of the mining business,” it said.

In addition, lower average skin prices will put pressure on EBITDA margins in the immediate term. “Padenga’s current loss position mirrors the unique period the company is in; balancing a shifting skins market, Covid-19 restrictions and recapacitating their mining business. It is likely that some recovery in the crocodile business and the expansion of the mining subsidiary will begin to lift the bottom line in the medium to long term,” IH stated.

EBITDA is anticipated to be US$33.70mn, while the EBITDA margin is expected to strengthen to 33%.